Chicago Rivet & Machine Co. (CVR): Key Stock Insights and Strategies

Understanding CVR’s Recent Financial Performance

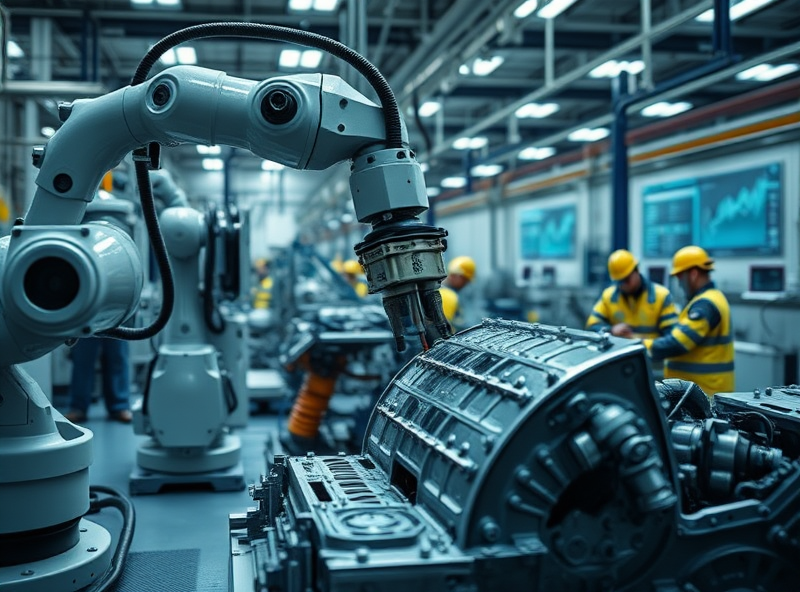

Chicago Rivet & Machine Co. (CVR) has been a key player in the industrial fasteners and riveting machinery industry for decades. To better understand its recent financial performance, let’s dive into some key insights. Over the past few quarters, CVR has shown steady revenue growth, driven by strong demand in the manufacturing and automotive sectors. This is a positive sign for investors, as it indicates the company’s ability to adapt to market needs and maintain a competitive edge. Additionally, CVR has been focusing on cost optimization, which has improved its profit margins. However, it’s important to keep an eye on external factors like raw material costs and supply chain disruptions, which could impact future performance. For potential investors, understanding these dynamics can help make informed decisions. By analyzing CVR’s financial health, you can assess whether it aligns with your investment goals and risk tolerance.

Analyzing Valuations and Dividend Strategies

When it comes to investing in Chicago Rivet & Machine Co. (CVR), understanding its valuation metrics and dividend strategies is crucial for making informed decisions. CVR, a company with a long-standing history in the industrial sector, has been known for its consistent dividend payouts, making it an attractive option for income-focused investors.

To analyze its valuation, start by examining the Price-to-Earnings (P/E) ratio. This metric helps you determine whether the stock is overvalued or undervalued compared to its earnings. A lower P/E ratio compared to industry peers may indicate a potential buying opportunity. Additionally, consider the Price-to-Book (P/B) ratio, which reflects the market’s valuation of the company relative to its book value. For dividend strategies, focus on the dividend yield and payout ratio. A high dividend yield can be appealing, but ensure the payout ratio is sustainable—ideally below 60%—to avoid risks of dividend cuts in the future.

By combining these valuation insights with a solid understanding of CVR’s financial health and industry trends, you can create a well-rounded investment strategy. Remember, investing is not just about chasing high yields but ensuring long-term growth and stability in your portfolio.

Risk Management and Trading Strategies for CVR

When it comes to investing in Chicago Rivet & Machine Co. (CVR), understanding and implementing effective risk management and trading strategies is crucial. CVR, as a niche industrial company, can experience fluctuations in its stock price due to factors like market demand, raw material costs, and economic conditions. To mitigate risks, consider diversifying your portfolio by investing in multiple sectors rather than focusing solely on CVR. This approach can help balance potential losses if CVR’s stock underperforms. Additionally, setting stop-loss orders is a smart way to limit potential losses by automatically selling the stock if it drops below a certain price. For trading strategies, staying informed about CVR’s financial reports, industry trends, and macroeconomic factors can help you make well-timed decisions. Remember, patience and a long-term perspective often yield better results in stock investments. Always consult with a financial advisor to tailor strategies to your unique goals and risk tolerance.

Market Trends and Industry Insights for CVR

Chicago Rivet & Machine Co. (CVR) operates in a niche but vital sector of the manufacturing industry, specializing in rivets and riveting machines. To understand the company’s potential, it’s essential to look at broader market trends and industry insights. The global demand for rivets is steadily increasing, driven by growth in industries like automotive, aerospace, and construction. As these sectors innovate and expand, the need for reliable fastening solutions like those provided by CVR becomes even more critical. Additionally, with the push towards automation and smart manufacturing, companies like CVR are well-positioned to integrate advanced technologies into their products, offering enhanced efficiency and precision. For investors, keeping an eye on how CVR adapts to these trends could provide valuable insights into its future growth and profitability.