Investment Outlook for PayPal Holdings (PYPL): Growth and Risks Analyzed

PayPal’s Financial Performance Overview

PayPal Holdings, Inc. has been a dominant player in the digital payments industry for years, but how does its financial performance hold up in today’s competitive market? As of recent reports, PayPal has demonstrated steady revenue growth, driven by the increasing adoption of digital payments worldwide. With millions of active accounts and a robust transaction volume, PayPal continues to expand its global footprint. However, investors should also consider the company’s operating margins, which have faced pressure due to rising competition and the costs associated with innovation and security enhancements. Additionally, PayPal’s ability to diversify its revenue streams, such as through Venmo and merchant services, plays a critical role in its financial health. For those looking to invest, understanding these key financial metrics and trends can provide valuable insights into PayPal’s long-term potential.

Price Forecasts: Short-term and Long-term Trends

PayPal Holdings (PYPL) has been a significant player in the digital payments space, and understanding its price trends can provide valuable insights for investors. In the short term, PayPal’s stock price is influenced by quarterly earnings reports, market sentiment, and broader economic conditions. For instance, factors like rising interest rates or shifts in consumer spending can cause fluctuations. Analysts often look at metrics such as revenue growth, active user base expansion, and transaction volume to predict short-term movements.

In the long term, PayPal’s growth prospects hinge on its ability to innovate and expand its ecosystem. The company’s investments in digital wallets, cryptocurrency integration, and partnerships with e-commerce platforms are key drivers for sustained growth. However, long-term risks include increasing competition from fintech rivals and regulatory challenges in different markets. By staying informed about these trends, investors can make more strategic decisions about their portfolios.

Growth Drivers: AI, Digital Currencies, and Venmo

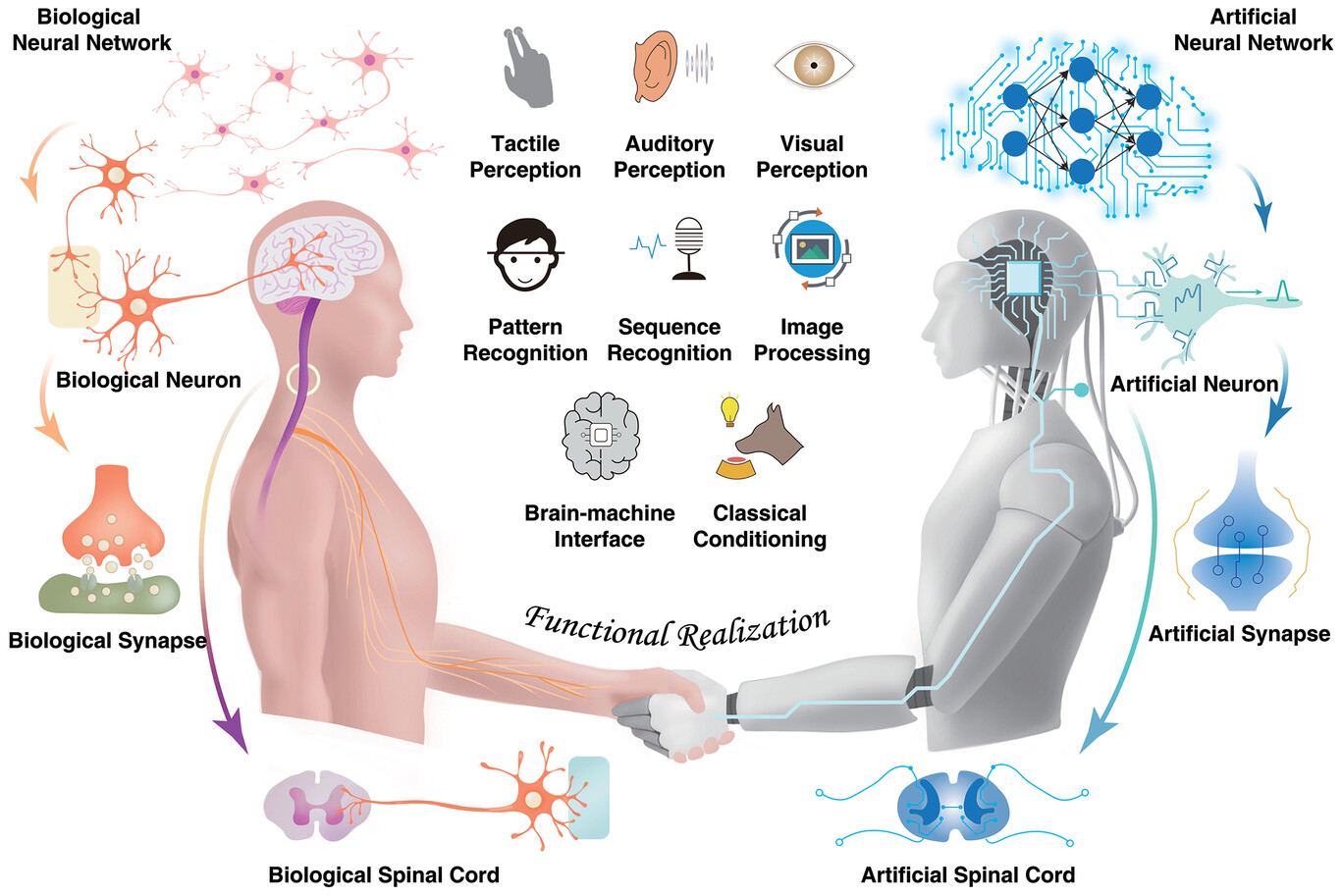

PayPal Holdings (PYPL) is at the forefront of innovation, leveraging cutting-edge technologies to drive growth and enhance user experiences. One of the most significant growth drivers for PayPal is its integration of Artificial Intelligence (AI). AI plays a crucial role in fraud detection, transaction security, and personalized financial services. By analyzing vast amounts of data in real-time, PayPal’s AI systems help detect suspicious activities, ensuring safer transactions for users. Additionally, AI-powered tools enable personalized recommendations, making financial management more intuitive and efficient for individuals and businesses alike.

Another major growth factor is PayPal’s strategic focus on digital currencies. With the increasing adoption of cryptocurrencies, PayPal has embraced this trend by allowing users to buy, sell, and hold cryptocurrencies directly within its platform. This not only caters to the growing demand for digital assets but also positions PayPal as a key player in the evolving financial ecosystem. By simplifying access to cryptocurrencies, PayPal empowers users to participate in the digital currency revolution with ease and confidence.

Lastly, Venmo, PayPal’s peer-to-peer payment platform, continues to be a significant growth driver. Venmo’s popularity among younger demographics has made it a go-to app for splitting bills, paying friends, and even shopping online. With features like Venmo Credit Cards and business profiles, the platform is expanding its utility beyond personal transactions, creating new revenue streams for PayPal. The combination of AI, digital currencies, and Venmo ensures that PayPal remains a leader in the fintech space, offering innovative solutions that cater to the evolving needs of its users.

Risks and Challenges for Investors

Investing in PayPal Holdings (PYPL) can be an exciting opportunity, but like any investment, it comes with its own set of risks and challenges. One of the primary concerns for investors is the intense competition in the digital payments industry. Companies like Square, Stripe, and even tech giants like Apple and Google are constantly innovating, which puts pressure on PayPal to stay ahead. Additionally, regulatory challenges in different countries can pose significant hurdles, as PayPal operates globally and must comply with varying laws and policies. Another key risk is cybersecurity. As a digital payments company, PayPal is a prime target for cyberattacks, and any breach could damage its reputation and customer trust. Lastly, macroeconomic factors such as inflation, interest rate changes, and economic slowdowns can impact consumer spending and, in turn, PayPal’s transaction volumes. As an investor, it’s crucial to stay informed about these risks and evaluate how they align with your financial goals and risk tolerance.