Marvell Technology Stock: Investment Insights and Future Trends

Short-Term Volatility in Marvell Stock

Marvell Technology, a leading semiconductor company, has been a focal point for investors due to its role in advancing technologies like 5G, cloud computing, and AI. However, as with many tech stocks, Marvell’s stock price has experienced short-term volatility, which can be both an opportunity and a challenge for investors.

Short-term volatility in Marvell stock is often influenced by several factors, including earnings reports, market sentiment, and broader economic conditions. For instance, unexpected earnings results or changes in guidance can lead to significant price swings. Additionally, macroeconomic factors such as interest rate changes or geopolitical events can amplify this volatility.

For investors, understanding this volatility is crucial. While short-term price fluctuations may seem daunting, they often present opportunities for those with a long-term perspective. Staying informed about Marvell’s financial performance, technological advancements, and market trends can help investors make more confident decisions. Moreover, diversification and a clear investment strategy can mitigate the risks associated with such volatility.

In conclusion, while short-term volatility in Marvell stock may be unsettling, it is a natural part of investing in innovative tech companies. By staying informed and focusing on long-term growth potential, investors can navigate these fluctuations and potentially benefit from Marvell’s promising future.

Long-Term Opportunities in AI Growth

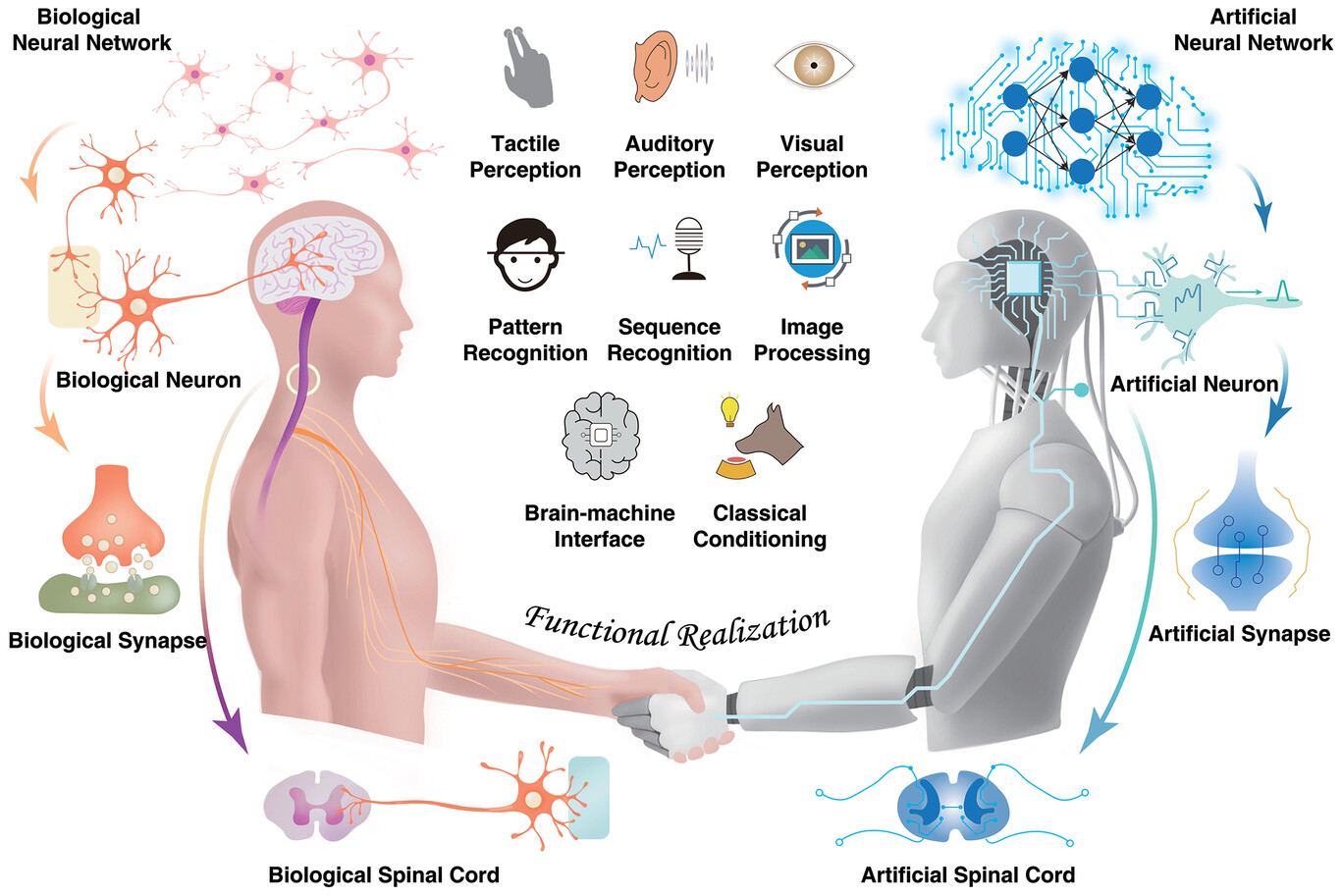

Artificial Intelligence (AI) is rapidly transforming industries, and Marvell Technology is well-positioned to benefit from this growth. The company’s focus on advanced semiconductor solutions aligns perfectly with the increasing demand for AI-driven applications. From data centers to edge computing, AI requires high-performance chips capable of processing vast amounts of data efficiently. Marvell’s innovative products, such as custom ASICs and DPUs, are tailored to meet these needs, making them a key player in the AI revolution.

Moreover, the AI market is expected to grow exponentially in the coming years, with applications spanning healthcare, automotive, and telecommunications. For instance, AI is driving advancements in autonomous vehicles, predictive maintenance, and personalized medicine. By investing in Marvell Technology, you’re not just investing in a company but in the future of AI-powered innovation. Long-term investors could benefit significantly as the demand for AI solutions continues to rise globally.

In summary, Marvell Technology offers a compelling opportunity for those looking to capitalize on the long-term growth of AI. Their cutting-edge technology and strategic positioning make them a promising choice for forward-thinking investors.

Key Financial Performances and Forecasts

Marvell Technology has been a key player in the semiconductor industry, consistently delivering innovative solutions in data infrastructure and AI-driven technologies. Over the past few years, the company has shown robust financial performance, driven by strong demand for its products in cloud computing, 5G, and automotive sectors. In its most recent earnings report, Marvell posted revenue growth that exceeded analysts’ expectations, reflecting its strategic investments in high-growth markets. Analysts are optimistic about the company’s future, forecasting continued growth as Marvell expands its portfolio and strengthens its partnerships with industry leaders. For investors, this presents an exciting opportunity to capitalize on a company that is at the forefront of technological advancements. However, as with any investment, it’s essential to consider market conditions and conduct thorough research before making decisions.

Risks and Strategic Considerations

When investing in Marvell Technology stock, it’s essential to consider both the potential risks and strategic factors that could influence your decision. One of the primary risks lies in the semiconductor industry’s inherent volatility. Market demand for semiconductors can fluctuate due to global economic conditions, supply chain disruptions, or shifts in technology trends. For instance, a sudden downturn in consumer electronics demand could impact Marvell’s revenue streams.

Another critical consideration is competition. Marvell operates in a highly competitive market with key players like NVIDIA, Intel, and AMD. Staying ahead in innovation and maintaining strong partnerships will be crucial for Marvell’s sustained growth. Investors should also keep an eye on the company’s R&D investments and how effectively they translate into marketable products.

On the strategic side, Marvell’s focus on 5G infrastructure, cloud computing, and AI-driven solutions presents significant growth opportunities. These sectors are expected to expand rapidly in the coming years, and Marvell’s ability to capture market share in these areas could drive long-term value for shareholders. Additionally, understanding the company’s financial health, such as debt levels and cash flow, can provide deeper insights into its resilience during economic downturns.

In summary, while Marvell Technology offers exciting prospects, a balanced approach that considers both risks and strategic opportunities will help investors make informed decisions. Diversifying your portfolio and staying updated on industry trends can further mitigate potential risks.