Nortech Systems (NSYS) Stock Insights and Strategies

Company Overview of Nortech Systems (NSYS)

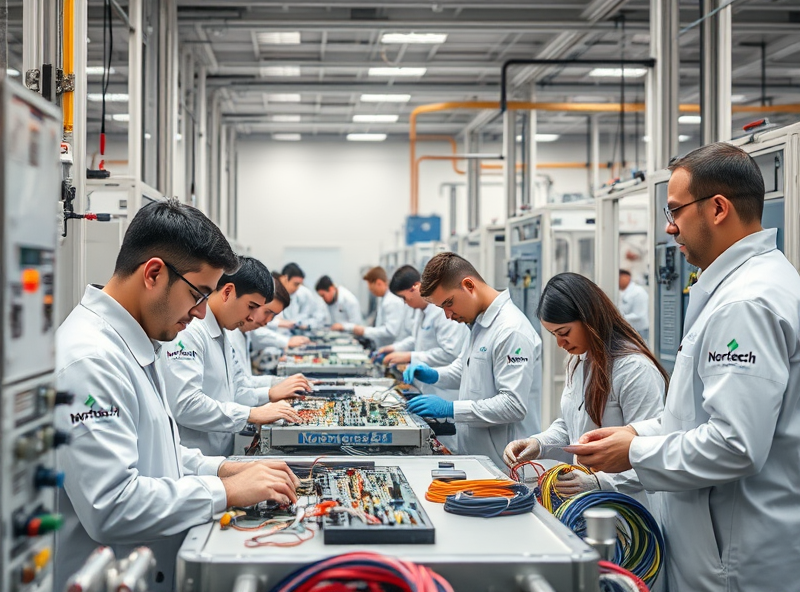

Nortech Systems (NSYS) is a trusted provider of innovative electronic manufacturing services (EMS) and connectivity solutions. Headquartered in Minnesota, USA, the company has been serving diverse industries such as medical, industrial, and aerospace for decades. Nortech Systems specializes in delivering high-quality custom solutions, including wire harness assemblies, printed circuit board assemblies, and complete box builds. Their commitment to precision, reliability, and customer satisfaction has earned them a solid reputation in the EMS industry. By leveraging advanced technologies and a customer-centric approach, Nortech Systems helps businesses optimize their supply chains and bring innovative products to market efficiently. Whether you’re an investor or a business looking for a reliable EMS partner, understanding Nortech Systems’ capabilities can provide valuable insights into their potential for growth and collaboration.

NSYS Stock Snapshot and Recent Trends

Nortech Systems (NSYS) is a name that has been catching the attention of investors lately, and for good reason. As a provider of engineering and manufacturing services, NSYS plays a critical role in industries like medical devices, aerospace, and industrial equipment. Recently, the stock has shown interesting movements, with a mix of steady growth and occasional volatility. For those looking to invest, understanding these trends is key.

One of the recent trends for NSYS stock is its resilience in adapting to market demands. The company has been focusing on innovation and customer-centric solutions, which has positively impacted its financial performance. Additionally, NSYS has been leveraging its expertise in advanced manufacturing to cater to the growing demand in the medical and aerospace sectors. This strategic positioning has helped the company maintain relevance and attract investor interest.

For potential investors, keeping an eye on NSYS’s quarterly earnings reports and industry developments can provide valuable insights. It’s also important to note that while the stock shows promise, market conditions and external factors can influence its performance. Diversifying your portfolio and staying informed about broader market trends can help mitigate risks while maximizing potential gains.

Financial Performance Analysis of NSYS

Nortech Systems (NSYS) has been steadily gaining attention in the market due to its consistent financial performance and strategic business operations. When analyzing the financial performance of NSYS, it’s essential to focus on key metrics such as revenue growth, profit margins, and cash flow. Over the past few years, NSYS has demonstrated resilience in navigating market challenges, showing a steady increase in revenue driven by its diversified client base and strong operational strategies.

One of the standout aspects of NSYS is its commitment to innovation and adapting to market trends. By investing in advanced manufacturing technologies and focusing on customer-centric solutions, the company has managed to maintain competitive profit margins. Additionally, their effective cost management strategies have allowed them to generate healthy cash flow, which is critical for sustaining long-term growth.

For investors, it’s important to note that NSYS has a strong balance sheet with manageable debt levels, which reduces financial risk. The company’s consistent performance and forward-looking strategies make it a promising option for those looking to invest in the industrial and manufacturing sector. Always remember to review the latest quarterly and annual reports to stay updated on their financial health and market position.

Investment Strategies for Handling NSYS Stock Movements

When it comes to investing in Nortech Systems (NSYS), having a well-thought-out strategy is key to navigating the stock’s movements. NSYS, being a small-cap company, can exhibit higher volatility compared to larger, more established firms. Here are some actionable strategies to help you make informed decisions:

1. **Understand the Fundamentals**: Before making any investment, take time to analyze NSYS’s financial health, revenue growth, and market position. Review their quarterly earnings reports and assess their long-term business strategy.

2. **Diversify Your Portfolio**: To mitigate risk, avoid putting all your capital into NSYS. Instead, diversify your investments across different sectors and asset classes. This will help cushion your portfolio against any sudden drops in NSYS stock.

3. **Set Clear Entry and Exit Points**: Define your investment goals and decide on price levels at which you will buy or sell NSYS stock. This disciplined approach can help you avoid emotional decision-making during market fluctuations.

4. **Stay Updated on Industry Trends**: NSYS operates in the electronics manufacturing services (EMS) sector. Keep an eye on industry trends, technological advancements, and economic factors that could impact the company’s performance.

5. **Consider Dollar-Cost Averaging**: If you’re unsure about the right time to invest, consider dollar-cost averaging. This involves investing a fixed amount in NSYS stock at regular intervals, which can help reduce the impact of market volatility.

6. **Monitor Analyst Ratings and News**: Pay attention to analyst reports and news about NSYS. While these shouldn’t be your sole decision-making tools, they can provide valuable insights into market sentiment.

By employing these strategies, you can approach NSYS stock movements with confidence and make more informed investment decisions. Remember, investing always carries risks, so ensure your strategy aligns with your financial goals and risk tolerance.